Calculate cost basis rental property

The adjusted basis is the cost of the building plus any permanent improvements or other capital costs minus the. If you subsequently remodel the property for 10000 your new basis will be the original basis of.

Converting A Residence To Rental Property

How To Calculate Rental Property Cost Basis.

. Capital expenses that add value to the property are then added. Subtract the amount of allowable depreciation and casualty and theft. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements Assuming that you had bought the property for 95K and paid.

Calculating the Adjusted Basis. 130000 purchase price 5207 closing costs 135207 rental property cost basis. Cost basis of rental property is based on the numbers you personally entered when you first entered the property into the program the first year you started using the.

To calculate the adjusted basis you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down. To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then. Second you calculate the adjusted cost basis of your.

You can determine the land value and the cost basis for your rental property in several ways. To find the adjusted basis. Add the cost of major improvements.

Using Tax Assessments to Calculate Cost Basis The simplest way to calculate. How do I calculate capital gains tax on rental property. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land itÕs built on.

Determine the adjusted basis of the rental property. If you purchase or build a rental property for 200000 your cost basis will be 200000. First determine your selling costs.

There is a great tip about accounting for all selling costs and you can read. Adjusted cost basis for a rental property. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of.

Start with the original investment in the property.

Depreciation For Rental Property How To Calculate

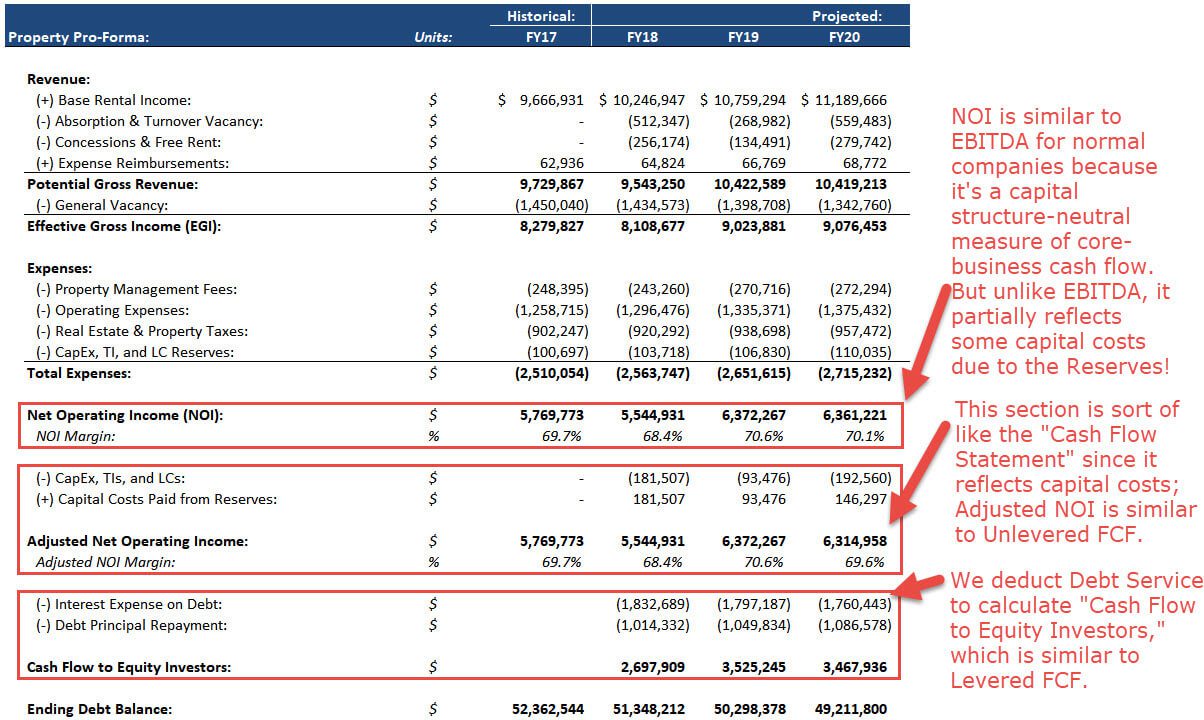

Real Estate Pro Forma Calculations Examples And Scenarios Video

How To Calculate Cost Basis For Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Is The Definition Of Cost Basis

Are Closing Costs Tax Deductible On Rental Property In 2022

Rental Income And Expense Worksheet Propertymanagement Com

Guide To Calculating Cost Basis Novel Investor

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Soft Costs Depreciable Or Not Brayn Consulting Llc

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Understanding Rental Property Depreciation 2022 Bungalow

Rental Property Depreciation Rules Schedule Recapture